It’s been an interesting summer, with steep global sell offs, thanks to China, and two defaults, courtesy of Puerto Rico and Greece, all tied in with the fear of the rate hike. We are reminded more than ever of the importance of a diverse portfolio so as to mitigate our risks and grow our money into our gray-haired days.

O’Shares’ newest ETFs thus launch at a perfect time, allowing investors of all sorts the opportunity to spread risk across a number of different sectors and markets. Below, we take a look at the latest offerings from O’Shares:

O'Shares Applies Smart-Beta to Europe and Asia Pacific

This morning, O’Shares Investments announced the launch of four new smart-beta, dividend ETFs, which will join the issuer’s first fund, the FTSE US Quality Dividend ETF (OUSA ):

- O’Shares FTSE Europe Quality Dividend ETF (OEUR )

- O’Shares FTSE Europe Quality Dividend Hedged ETF (OEUH )

- O’Shares FTSE Asia Pacific Quality Dividend ETF (OASI )

- O’Shares FTSE Asia Pacific Quality Dividend Hedged ETF (OAPH )

The new ETFs follow similar indexes to OUSA, tracking dividend-paying companies that meet certain requirements for market capitalization, liquidity, high quality, low volatility, and dividend yield. The high quality and low volatility requirements are designed to reduce exposure to high dividend equities that have experienced large price declines, as may occur with some dividend investing strategies (this is also called a Dividend Value Trap). Like OUSA, each fund also caps its allocation to a single security at 5% of total assets.

Each ETF targets large- and mid-cap dividend-paying stocks across developed Europe and developed Asia Pacific. And for those looking to hedge against currency fluctuations between the U.S. dollar and the underlying foreign currencies, the hedged-versions – OEUH and OAPH – may be a more compelling option, particularly for those bullish on the greenback.

Under the Hood: OEUR & OEUH

The European pair of Smart-Beta ETFs track the FTSE Europe Qual / Vol / Yield Factor 5% Capped Index and FTSE Europe Qual / Vol / Yield Factor 5% Capped Hedged 100% to USD Index.

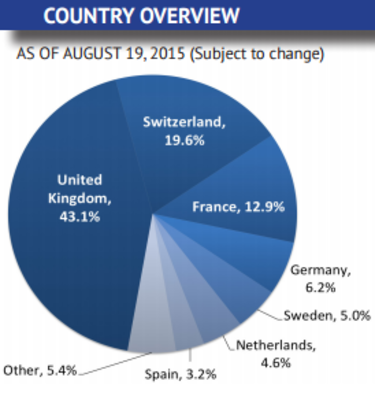

OEUR and OEUH comprise 144 individual securities, which have an average market capitalization of roughly $24 billion (USD). Currently, stocks from the United Kingdom account for a vast majority of total assets (43.1%). Equities from Switzerland and France receive the next biggest weightings, while meaningful exposure is also allocated to Germany, Sweden, Netherlands, and Spain.

In terms of sector diversification, health care and consumer goods equities are allocated just under 20% of total assets each. Oil & gas, telecom, and financials receive the next biggest allocations, at over 10% of AUM each.

As of 8/24/2015, the top 10 holdings are as follows:

| Country | Name | Weight |

|---|---|---|

| Switzerland | Novartis | 5.06% |

| Switzerland | Nestle | 5.01% |

| Switzerland | Roche Hldgs | 4.94% |

| United Kingdom | Vodafone Group | 4.63% |

| United Kingdom | British American Tobacco | 4.42% |

| United Kingdom | GlaxoSmithKline | 3.47% |

| France | Total | 3.01% |

| France | Sanofi | 2.98% |

| United Kingdom | Royal Dutch Shell | 2.82% |

| United Kingdom | AstraZeneca | 2.67% |

OEUR charges an expense ratio of 0.58%. OEUH charges 0.68%.

Under the Hood: OASI & OAPH

OASI and OAPH track the un-hedged and hedged versions of the FTSE Developed Asia Pacific Qual / Vol / Yield Factor 5% Capped Index, respectively.

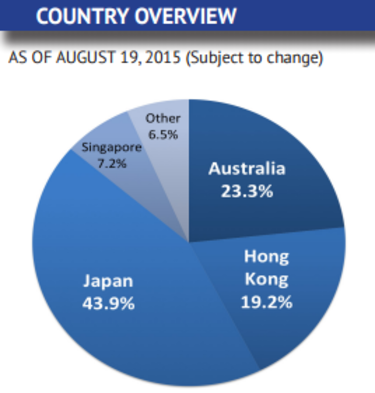

The funds invest in just under 250 securities, making them deeper than its Europe and U.S. counterparts. Equities from Japan make up roughly 44% of the portfolio. Stocks from Australia, Hong Kong and Singapore receive allocations of 23.3%, 19.2%, and 7.2%, respectively. In regards to sector diversification, OASI and OAPH are heavily tilted towards financials, industrials, and consumer services, which combined account for almost half of total assets. Consumer goods, telecom, and basic materials also receive allocations of over 10% each.

As of 8/24/2015, the top 10 holdings are as follows:

| Country | Name | Weight |

|---|---|---|

| Australia | BHP Billiton | 4.57% |

| Hong Kong | CK Hutchison Holdings | 3.33% |

| Japan | NTT Docomo | 3.18% |

| Korea | Samsung Electronics | 2.64% |

| Australia | Wesfarmers | 2.63% |

| Hong Kong | Sun Hung Kai Properties | 2.09% |

| Japan | Seven & i Holdings | 2.07% |

| Japan | Canon | 1.90% |

| Hong Kong | Cheung Kong Property | 1.87% |

| Japan | Japan Tobacco | 1.82% |

OASI charges 0.58%, while OAPH charges 0.68%.

Kevin O'Leary on the Launches

Commenting on the launches, Kevin O’Leary stated, “Following the successful launch of OUSA, it was important for my family trust to maintain the same consistent rules-based investment solution on a global basis and we believe these new ETFs offer individual and institutional investors a comprehensive suite of capital efficient, transparent and cost-effective, index-based products that reflect these core investment principles. Moreover, offering both a hedged and unhedged index for the international strategies provides tools for investors, such as me, with different outlooks on currency movements or different risk tolerances, to capture the multi-factor strategy in a way that’s best aligned with their individual or institutional mandates.”

Be sure to also check out our Q&A with Kevin O’Leary and Connor O’Brien about OUSA.

Follow me on Twitter @DPylypczak.

Disclosure: No positions at time of writing.