Recent tariff news has caused a broad shock across the market, including international investments, the retail and manufacturing sector, and even ethereum. As a former transportation analyst, its effect on the transportation sector has caught my attention.

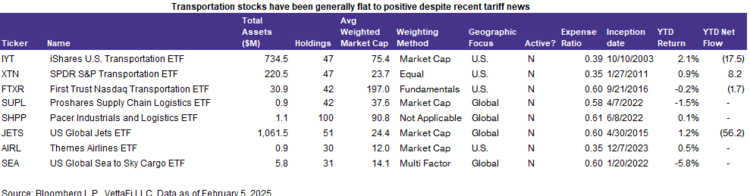

While tariffs could potentially be harmful to transportation companies, the market reaction has been surprisingly mild despite several sell-side analyst downgrades. Transportation ETFs have performed generally flat to slightly positive YTD with certain subcategories of transportation stocks affected more than others. Due to the current market uncertainty, it is important to know what is inside your transportation ETF. This note will provide a brief overview.

(Just for fun — here is a picture of me driving a train simulator at the Canadian Pacific headquarters in Calgary, Alberta at their 2018 Investor Day.)

How Is the Transportation Industry Affected by Tariffs?

Tariffs are taxes on imported goods. The taxes are levied on the importers (i.e., the U.S. businesses). Exporters (i.e., the foreign businesses) may also suffer, since U.S. businesses may switch to onshoring to avoid taxes. Alternatively, U.S. businesses may pass the cost onto consumers contributing to price inflation.

Freight transportation and supply chain companies end up in the middle. That’s because tariffs could reduce volumes, which directly affects revenue and profits. Transportation companies could raise shipping prices to make up lost revenue. But then they risk losing customers also facing rising import costs. The effect will vary widely depending on exposure to international customers.

Railroad companies will likely feel a larger impact due to the North American networks between Canada, U.S., and Mexico. Parcel companies may also feel a significant effect due to strains in Chinese e-commerce. Many truckload companies tend to operate domestically, but might still experience issues further up the supply chain. Much of this, however, depends on how customers can navigate these uncertainties. With a one-month pause on tariffs, customers may have time to pull forward some orders before figuring out longer term strategies.

Union Pacific (UNP) is the largest North American railroad by market capitalization. On its January 23 earnings call, CEO Jim Vena stated that although they were prepared for a negative scenario, both positives and negatives for the industry outside of tariffs exist. “I look at the entire package. If we get tariffs, but we also get the regulatory changes and we get the tax changes that were talked about by the President…that could be a lot of positive.” Freight transportation companies have experienced steel and aluminum tariffs in President Trump’s first term, in addition to pandemic related disruptions to the supply chain. Most of these companies have had recent experience navigating different demand cycles, likely at least partially priced into the stocks.

Inside Transportation ETFs: What Is a Transportation Stock?

Looking at the big picture, freight transportation stocks are cyclical and tend to do well when the economy does well. Factors like consumer demand and manufacturing demand support these stocks. And loads range from small retail items to industrial products to agricultural products. Recently, the industry has made strides with advanced logistics and robotics, including both electric and autonomous technologies.

Subcategories of stocks include a broad range of transportation modes. Air and ocean freight carriers are generally responsible for transportation freight internationally through maritime shipping or through freight plane and passenger planes. According to the International Air Transportation Association, around 30%-50% of airfreight has flown in the belly of passenger flights over the past few years.

On land, freight can travel over one (but usually more) means of transportation. Seven major railroads operate across North America (five of these are public companies, but two of those five are Canadian). There are only a handful of public trucking companies. But it’s a largely fragmented space. Over 95% of trucking come from private trucking companies with fleets of 10 or fewer vehicles (according to the American Trucking Associations). Transportation also includes multimodal parcel companies like United Parcel Service (UPS) and FedEx Corp FDX. It can also extend to trucking and rail manufacturers.

Transportation ETFs:

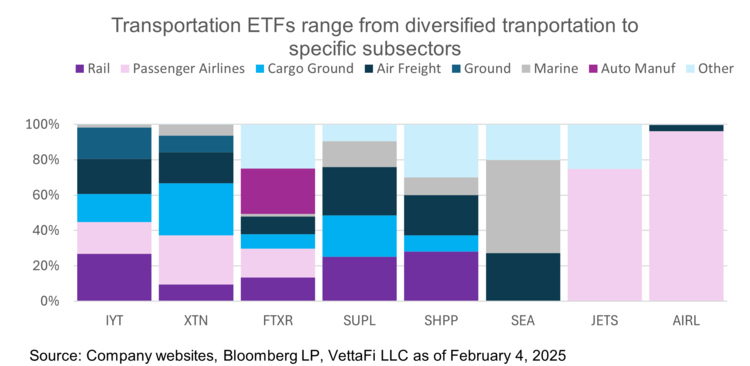

- The iShares U.S. Transportation ETF (IYT ) is the oldest and largest transportation ETF, with $700 million in assets. This ETF express a sector view for transportation stocks, including U.S. airline, railroad, and trucking companies. Companies get weighted using a float-adjusted market cap method. Its top holding is Union Pacific (17.6% of weight) followed by Uber Technologies (UBER) (16.5% of weight).

- The SPDR S&P Transportation ETF (XTN ) was launched several years after IYT. It has $220 million in assets. Unlike IYT, XTN is equal-weighted. That gives it more weight to smaller-cap trucking stocks versus large-cap railroads and airlines. Every stock in IYT is currently also in XTN. So these two are the most similar out of the entire group.

- The First Trust Nasdaq Transportation ETF (FTXR ) is fundamentally weighted. It has a far different weighting scheme than its peers. Security selection is based on: 1) trailing 12-month return on assets; 2) trailing 12-month gross income; and 3) momentum and weighting is based on trailing 12-month cash flow. This ETF also holds some consumer discretionary companies in the automotive sector. These include Tesla (TSLA), General Motors (GM), and Ford (F) which are three out of the top five holdings. IYT and XTN have expense ratios of 39 bps and 35 bps, respectively. FTXR has a higher expense ratio of 60 bps.

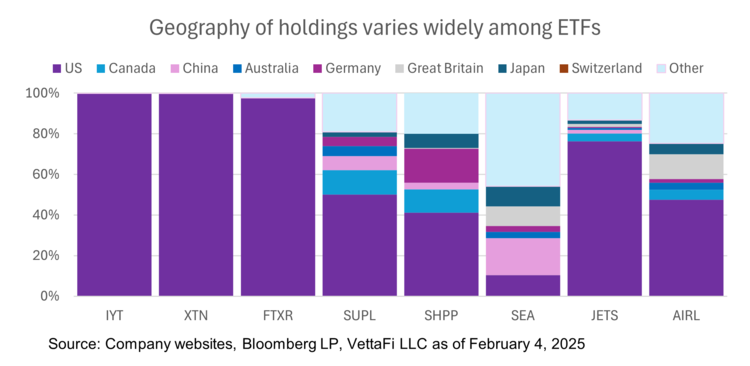

- ProShares Supply Chain Logistics ETF (SUPL ) and the Pacer Industrials and Logistics ETF (SHPP ) were both launched around the same time frame in 2022. Each has around $1 million in assets. SUPL focuses on companies with raw materials and merchandise shipping. SHPP focuses on transportation, logistics, robotics, and ancillary services. Unlike the previous three ETFs, SUPL and SHPP both contain non-U.S.-based companies. These include two of the five major North American railroads, which are Canadian companies.

- US Global Sea to Sky Cargo ETF (SEA ) focuses on maritime and airfreight shipping rather than over-the-ground trucking and rail. This ETF has a large allocation to international stocks. Its largest geographic weighting is China, with over 16% of its weight. Only 10% of its weight is in U.S. stocks, which includes parcel carriers like FedEx and UPS.

- U.S. Global Jets ETF (JETS ) and the Themes Airlines ETF (AIRL) both focus on the passenger airline industry. Well-established JETS has over $1 billion in assets (launched in 2015). AIRL recently launghed in December 2023 and has under $1 million in assets. One of the primary differences is that JETS holds booking companies like TripAdvisor (TRIP), Booking Holdings (BKNG), and Expedia Group (EXPE). JETS also has a larger allocation to U.S. stocks, with around 76% of its weight versus 48% of AIRL’s weight.

For more news, information, and strategy, visit ETFDB.