The extrinsic prices of options are impacted by several factors beyond that of the underlying security’s price. These include the role of time, implied volatility, dividends, and interest rates as explained in a video series available with BMO. Using option Greeks, which are different types of risk measures that affect options prices and are represented by Greek letters, investors may better understand the role these factors play on the option premium’s price.

Delta

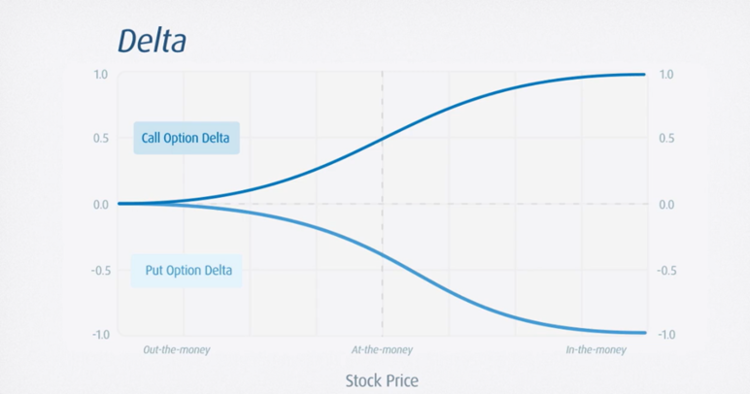

Delta is the expected amount an option’s premium will change for every $1 the underlying asset’s price changes. It’s measured in a range between -1 to 1, with zero indicating little to no change in the option premium regardless of underlying price movement. Long calls, long stocks, and short put options have positive deltas as they are bullish. Meanwhile short calls, short stocks, and long puts have negative delta and are considered bearish.

A call option becomes in the money when prices rise to meet the strike price. A long call option’s delta nears 1 as it becomes deeper in the money or more closely correlated to the underlying asset’s price. A long call option with a delta of around 0.50 but not actually at 0.50 is considered near the money, while less than 0.50 is out of the money. A long call option is considered “at the money” when its delta is 0.50.

On the other hand, a put option becomes in the money as prices fall to meet the strike price. A long put option’s delta nears -1 as it becomes deeper in the money. A long put option with a delta around -0.50 is considered near the money, while between 0 and -0.50 is out of the money. A long put is at the money when its delta is -0.50.

A delta of 1 for a call indicates the option premium moves on a 1:1 basis with the underlying asset. A call option with a delta of 0.70 indicates an option’s premium rises $0.70 for every dollar the underlying rises.

Conversely, a delta of -1 for a put option indicates the option premium moves on a 1:1 basis with the underlying asset. A put option with a delta of -0.60 indicates an option’s premium rises $0.60 for every dollar the underlying declines.

Delta is often used to gauge the likelihood of an option expiring in the money. Options with higher deltas have a greater chance of expiring in the money than those with low deltas. An option with a delta of 0.30 has a 30% chance to expire in the money, while a delta of 0.70 has a 70% chance.

Gamma

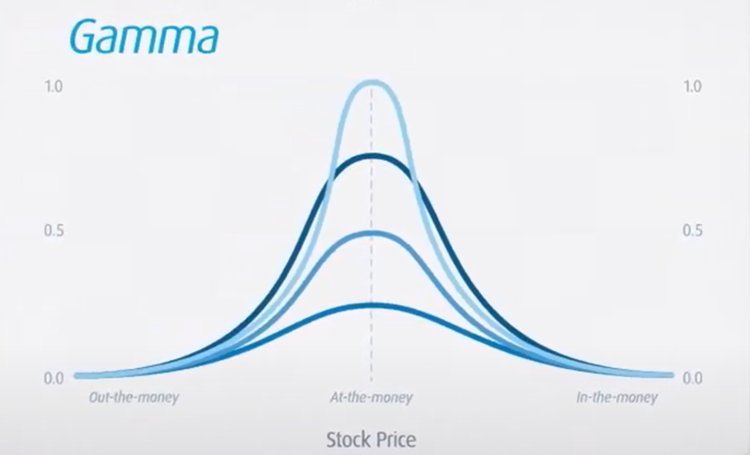

Gamma is directly related to delta in that it measures delta’s rate of change over time. It uses the same range as delta (-1 to 1), with positive gamma for long calls and puts and negative gamma for short calls and puts. Higher gamma generally reflects a greater increase in the option’s dollar value.

And near-the-money options have the highest gamma, while deep-in and out-of-the-money options have the lowest gamma. Deep out of the money options have low gamma because the option’s price must change significantly before acquiring intrinsic value. However, deep-in-the-money options have low gamma because the option price already closely reflects the underlying price, with little movement required.

Another way to think about gamma is that it helps determine how likely an option is to reach its strike price. Delta applies to price changes, but gamma is a measure of how much those price changes will fluctuate, or the delta’s stability over time.[LD1]

Options are not suitable for all investors. Investing in options carries substantial risk and tax consequences. Investors may realize losses on any investments made utilizing leverage. Future returns are not guaranteed, and use of leverage may magnify trading losses.

This article is prepared as a general source of information and is not intended to provide legal, investment, accounting or tax advice, and should not be relied upon in that regard. If legal or investment advice or other professional assistance is needed, the services of a competent professional should be obtained. Information contained in this article does not constitute and shall not be deemed to constitute advice, an offer to sell/ purchase or as an invitation or solicitation to do so for any entity. The content of this article is based on sources believed to be reliable, but its accuracy cannot be guaranteed. BMO InvestorLine Inc. and its affiliates, sponsors and employees do not accept responsibility for the content and makes no representation as to the accuracy, completeness or reliability of the content and hereby disclaims any liability with regards to the same. Any strategies discussed, including examples using actual securities, quotes and price data, are strictly for illustrative and educational purposes only and are subject to change without notice. BMO InvestorLine Inc. is not responsible for the information provided and disclaims all liability with regards to the same.

BMO InvestorLine Inc. is a member of BMO Financial Group. “BMO (M-bar Roundel symbol)” is a registered trademark of Bank of Montreal, used under licence. BMO InvestorLine Inc. is a wholly owned subsidiary of Bank of Montreal. Member – Canadian Investor Protection Fund and Member of the Canadian Investment Regulatory Organization.