Investors wanting to better understand options prices need to look beyond just the option price. The option Greeks measure how various elements, such as volatility and time, also impact an option’s price. They’re a way to quantify an option contract’s various risk factors.

Delta is generally used to determine how likely an option is to expire in-the-money. Meanwhile, gamma essentially measures the stability of delta, or how it changes over time. You can find a more comprehensive discussion here. Theta and Vega offer further insights regarding time and implied volatility, as explained by BMO in a video series.

Theta

Theta relates to time, or specifically time decay, in relation to an option. As time passes, an option’s price decreases because it is less likely to expire in the money. Theta quantifies this decay, measured in dollars, and reflects the expected premium reduction the next trading day. It also only relates to the extrinsic value of an option, not its intrinsic value.

Theta changes continuously and is typically negative for long positions and positive for short positions, but always moving toward zero. Theta negatively affects long calls and long puts and positively affects short calls and puts. It also behaves differently whether an option is at-the-money or out-of-the-money. At-the-money options have a high extrinsic value, reflected in the premium.

When an option is at-the-money, theta is highest (higher theta equates to greater option price reductions). It also increases the closer to the expiry an option moves, making it a nonlinear measurement. This occurs because an at-the-money option has more extrinsic value to lose the closer to expiry it gets.

Vega

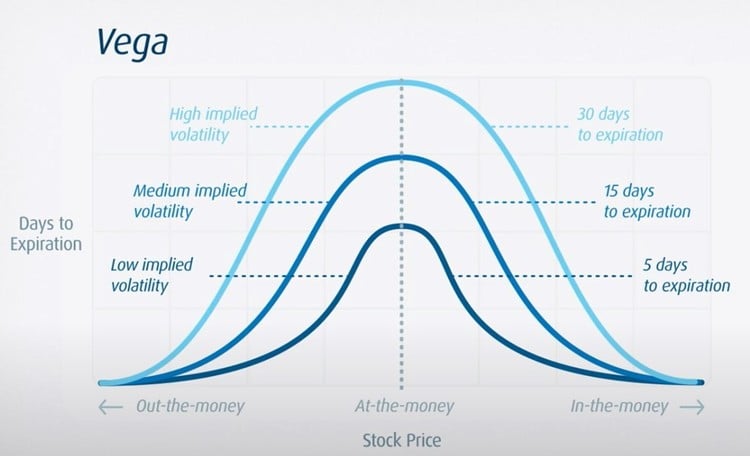

Vega measures the impact of the implied volatility of an underlying asset on an option’s price. Implied volatility reflects how volatile markets expect an asset to be throughout the option’s contract. It’s a forward-looking measurement determined from option prices. Vega is how much an option’s value changes per 1% change in the underlying asset’s implied volatility.

While delta and theta relate to price changes and time decay, vega accounts for expected market volatility. According to BMO, it’s theoretically highest when an option is at the money and declines as an option nears expiry. Vega is positive in relation to long calls and puts and negative in relation to short calls and puts.

Periods of greater market volatility create higher implied volatility, as do events such as impending earnings. Greater volatility drives up the price of options as they are more likely to reach their strike price. An option’s vega may rise or fall even if the underlying asset’s price remains stable due to changes in implied volatility.

Options are not suitable for all investors. Investing in options carries substantial risk and tax consequences. Investors may realize losses on any investments made utilizing leverage. Future returns are not guaranteed, and use of leverage may magnify trading losses.

This article is prepared as a general source of information and is not intended to provide legal, investment, accounting or tax advice, and should not be relied upon in that regard. If legal or investment advice or other professional assistance is needed, the services of a competent professional should be obtained. Information contained in this article does not constitute and shall not be deemed to constitute advice, an offer to sell/ purchase or as an invitation or solicitation to do so for any entity. The content of this article is based on sources believed to be reliable, but its accuracy cannot be guaranteed. BMO InvestorLine Inc. and its affiliates, sponsors and employees do not accept responsibility for the content and makes no representation as to the accuracy, completeness or reliability of the content and hereby disclaims any liability with regards to the same. Any strategies discussed, including examples using actual securities, quotes and price data, are strictly for illustrative and educational purposes only and are subject to change without notice. BMO InvestorLine Inc. is not responsible for the information provided and disclaims all liability with regards to the same.

BMO InvestorLine Inc. is a member of BMO Financial Group. “BMO (M-bar Roundel symbol)” is a registered trademark of Bank of Montreal, used under licence. BMO InvestorLine Inc. is a wholly owned subsidiary of Bank of Montreal. Member – Canadian Investor Protection Fund and Member of the Canadian Investment Regulatory Organization.