Option investors with a foundational understanding of and experience buying long calls and puts may look to sell options next. However, selling calls and puts results in a markedly different risk and return profile than their long option counterparts.

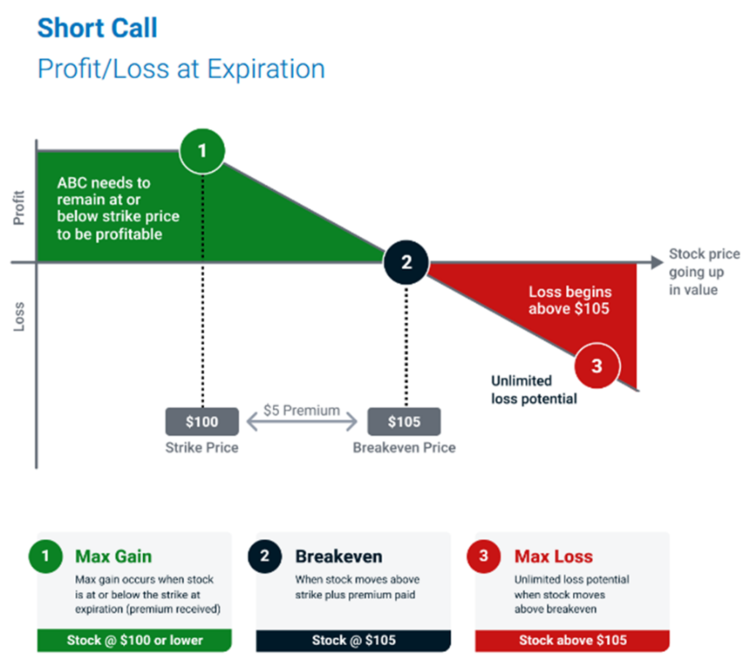

Short Calls

A short option refers to selling or writing options. The writer of a call agrees to sell an underlying asset at an agreed strike price by the contract’s expiration date. In return, they are paid a premium. Short call strategies often use the premiums earned on calls written as a source of income. They typically benefit in bearish or neutral market environments, BMO explained in an options investing course.

The goal of a short call holder is to have the option expire unexercised. This occurs when the underlying asset price fails to rise above the strike price (out-of-the-money). In this instance, the seller retains the premium without selling the underlying asset. An optimal outcome for short calls occurs when the underlying asset price rises but does not surpass the strike price by expiration.

While short calls have a narrowly defined return threshold, they can carry unlimited risk for the writer. A call writer who does not own the underlying asset when selling the call option—otherwise known as a naked (uncovered) call—opens themselves to infinite risk. As there is no upward limit on how much prices may rise, should the buyer choose to exercise the option, the writer is forced to buy the underlying at its higher prices to turn around and use them to fulfill the short call.

“This is how the short call writer faces unlimited loss potential if they do not already own the underlying security or another offsetting long position,” BMO explained.

A covered call, on the other hand, occurs when a call writer already owns or purchases the underlying asset at the time of writing the option. While this creates a different risk profile than a naked call, the writer still misses out on all capital appreciation of the underlying asset when prices rise.

Time also plays a critical role in options investing. As opposed to long calls, time decay works in favor of short calls. The closer a short call draws to expiration, the less likely it is to rise above the strike price. Short calls with longer expirations earn a higher premium but carry a higher risk for the writer.

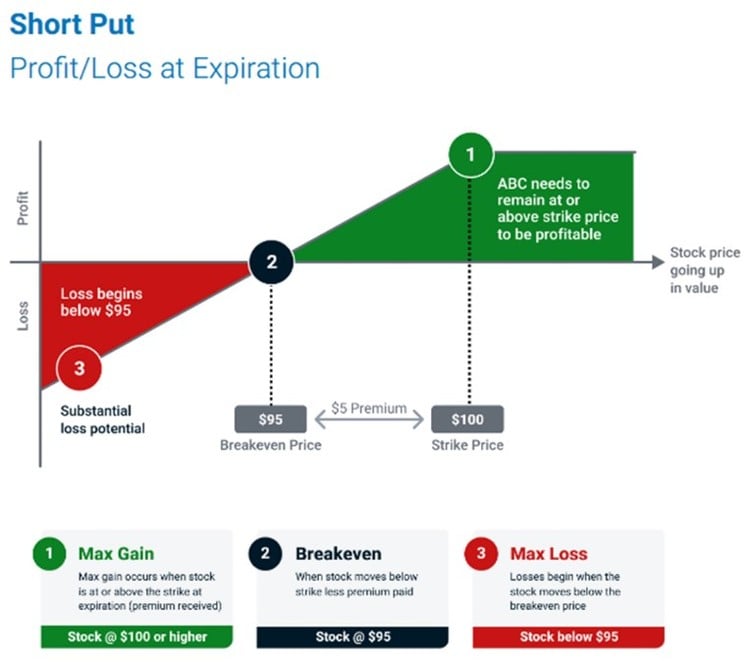

Short Puts

Opposite to a long put, a short put obligates the writer to buy an underlying security at the strike price by the expiration date. In return, the writer receives a premium. Short puts generally benefit in a bullish or neutral environment, according to BMO. The goal of a short put seller is to have prices remain above the strike price with the option expiring unused.

While short puts do not carry unlimited loss potential, they can have substantial loss potential. In a naked (uncovered) put, a put is written without the seller already owning the underlying, a short position in the underlying, or the necessary cash on hand to buy either. It’s a high-risk strategy with significant downside risk.

If the underlying asset’s price falls and the buyer exercises the option, the writer would have to purchase the underlying asset at the strike price. In declining markets, this strike price may be significantly above the current market price, leading to a substantial loss for the writer. A covered put entails holding a short position in the underlying to limit downside losses or having the cash on hand to buy into a short position.

As with short calls, time decay works in favor of short puts. The closer to expiration a short put option becomes, the lower the risk it will become in-the-money or fall below the strike price. A short put with longer days to expiration earns a higher premium but carries higher risk for the seller.

This article is prepared as a general source of information and is not intended to provide legal, investment, accounting or tax advice, and should not be relied upon in that regard. If legal or investment advice or other professional assistance is needed, the services of a competent professional should be obtained. Information contained in this article does not constitute and shall not be deemed to constitute advice, an offer to sell/ purchase or as an invitation or solicitation to do so for any entity. The content of this article is based on sources believed to be reliable, but its accuracy cannot be guaranteed. BMO InvestorLine Inc. and its affiliates, sponsors and employees do not accept responsibility for the content and makes no representation as to the accuracy, completeness or reliability of the content and hereby disclaims any liability with regards to the same. Any strategies discussed, including examples using actual securities, quotes and price data, are strictly for illustrative and educational purposes only and are subject to change without notice. BMO InvestorLine Inc. is not responsible for the information provided and disclaims all liability with regards to the same.

BMO InvestorLine Inc. is a member of BMO Financial Group. “BMO (M-bar Roundel symbol)” is a registered trademark of Bank of Montreal, used under licence. BMO InvestorLine Inc. is a wholly owned subsidiary of Bank of Montreal. Member – Canadian Investor