Investors delving into options for the first time might consider an option’s price the only indicator of its value. However, much more goes into determining an option’s value, such as intrinsic and extrinsic value. Understanding the difference between both allows for a more comprehensive understanding of an option’s price and may help set more realistic expectations for performance.

Intrinsic Value

Intrinsic value is an expression of how much an option is worth through its moneyness (i.e., whether it is in-, at-, or out-of-the-money). It only exists when an option is in-the-money. Intrinsic value measures the profit of an option if exercised today by calculating the difference between the option strike price and the current market price.

In long calls, an option has intrinsic value when the market price rises above the strike price. In long puts, this occurs when the market price falls below the option’s strike price.

“In other words, intrinsic value exists when the option contract contains more favorable terms than the market is pricing,” explained BMO in an options investing course.

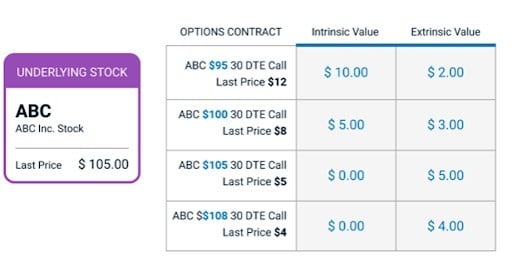

Putting this into theoretical practice, an investor buys a series of long calls on stock ABC. The current market price of ABC stock is $105, and the investor has long calls with strike prices at $95, $100, $105, and $108.

Only the $95 and $100 long call have intrinsic value, as they are in the money, with the current market price above their strike prices. The $95 long call has an intrinsic value of $10, while the $100 long call has an intrinsic value of $5. The $105 call option is at-the-money and, therefore, doesn’t provide any value if exercised. It does not have intrinsic value nor the out-of-the-money call option at $108.

In the above example, the extrinsic value is extrapolated by subtracting the intrinsic value from the option’s premium (last price). Options in the money have both intrinsic and extrinsic value, while those at or out of the money only have extrinsic value.

Extrinsic Value

The other main component to an option’s value is its extrinsic value. It’s determined by both the time value and the implied volatility of the option. Premiums of options are higher when there is more time left to expiration than when there is less. This happens because options with more time have a greater opportunity to end up in a favorable position than those near expiration. It’s worth noting that time value, and therefore extrinsic value, doesn’t degrade linearly but instead declines more rapidly the closer to expiration an option becomes.

Meanwhile, implied volatility measures market expectations of how the underlying asset will move. Earnings and company announcements, Federal Reserve meetings, major economic data, and more all affect implied volatility.

“On expiration, an option’s premium will reflect only its intrinsic value, which may be zero if the option is out-of-the-money,” BMO explained.

Understanding the role of intrinsic and extrinsic value in determining an option’s value allows investors to make more informed decisions when buying or selling options.

This article is prepared as a general source of information and is not intended to provide legal, investment, accounting or tax advice, and should not be relied upon in that regard. If legal or investment advice or other professional assistance is needed, the services of a competent professional should be obtained. Information contained in this article does not constitute and shall not be deemed to constitute advice, an offer to sell/ purchase or as an invitation or solicitation to do so for any entity. The content of this article is based on sources believed to be reliable, but its accuracy cannot be guaranteed. BMO InvestorLine Inc. and its affiliates, sponsors and employees do not accept responsibility for the content and makes no representation as to the accuracy, completeness or reliability of the content and hereby disclaims any liability with regards to the same. Any strategies discussed, including examples using actual securities, quotes and price data, are strictly for illustrative and educational purposes only and are subject to change without notice. BMO InvestorLine Inc. is not responsible for the information provided and disclaims all liability with regards to the same.

BMO InvestorLine Inc. is a member of BMO Financial Group. “BMO (M-bar Roundel symbol)” is a registered trademark of Bank of Montreal, used under licence. BMO InvestorLine Inc. is a wholly owned subsidiary of Bank of Montreal. Member – Canadian Investor Protection Fund and Member of the Canadian Investment Regulatory Organization.